Handling invoices to make sure they are processed, approved, and paid in a timely manner is as much a chore as it is an art. That’s because the accounts payable function in a company - regardless of size - relies on input from and almost 24/7 conversations with other departments in order to keep things running smoothly.

The concern over handling invoices still exists even though an increasing number of companies are switching to automated financial systems, embedding their purchase-to-pay workflow into the larger puzzle of ERP automation. This combination gives them a truly holistic view of all their inputs and outputs from supplies and manufacturing all the way to HR and marketing. After all, the more you measure, the better you can control what you have and see where there’s potential for growth.

Taking a Closer Look at Accounts Payable Automation

What exactly is it about AP that makes the difference?

At first glance, the AP function might not seem like the obvious candidate to have a significant impact on your bottom line. It’s all about seemingly tedious and repetitive tasks: ingesting invoices, purchasing orders and expense reports, routing them to the right people in an organization, catching erroneous submissions and duplicates, getting those invoices approved and finally paid on time. Seems pretty straightforward, right?

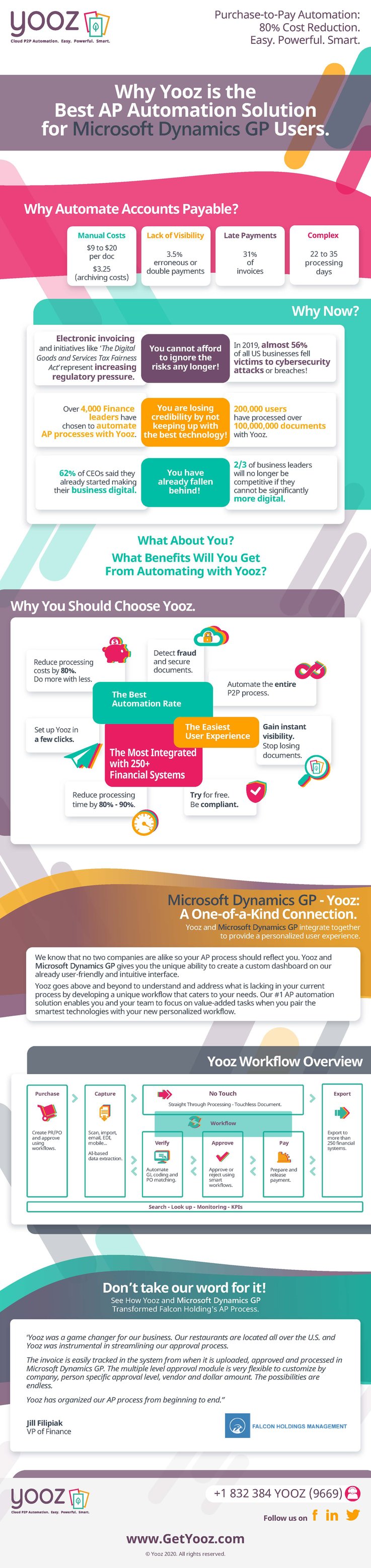

Statistics from companies that have embraced AP automation with the Yooz platform speak a clear language. It can cost between $9 and $20 to manually process an invoice, plus another $3.90 per document for archiving. Replacing those manual tasks with an automated, touchless process can save an organization on average 80% of processing costs and cut cycle time by 10% to 20%. All this thanks to smart technologies replacing the need for the extra materials you need to ship or create invoices combined with lightning-fast processing speeds.

What’s more, a cloud-based platform like Yooz understands, indexes, and stores every document securely in the cloud. This means that it will catch duplicate or erroneous payments without human intervention. That translates to avoiding dealing with 1 in 30 invoices that traditionally would need to be manually double-checked for a potential error.

The Many Benefits of AP Automation

The benefits don't stop with just the invoice process. Accounts Payable automation also cuts back on repetitive late fees. When you consider that close to one-third of all invoices tend to be paid past their due date, this amount of "extra" payables can have a serious impact on any company's cash management situation. An automated system prevents this, ensuring that invoices are prioritized and processed by due dates. In fact, thanks to automation payables can actually become a new revenue source by locking in early-pay discounts that a vendor may offer.

When you combine the two parts - the possibility of this new revenue with reduced processing costs (thanks to a dramatic decrease in cycle times as described above) - add on increased error and fraud protection (thanks to modern technology data extraction methodology, image capture, and indexing features). Let's also not forget the benefits of endless storage possibilities and a complete audit trail. These are just a few of the benefits that ensure that your processing time will drop from the average timespan of three to four weeks to just a few days.

Even better: implementing Account Payable automation with Yooz means that your new payable solution can be ready to use in just a very short time frame. The entire Yooz platform lives in the cloud and runs on your team's browser or mobile devices allowing them to work anytime and anywhere. No out-of-office workflow delays and no late payables.

If all these benefits come from automation why have an ERP? Or if my ERP and AP capability, why use a separate automation platform?

ERP and AP Automation Can Click

An Enterprise Resource Planning system (ERP) is usually a software package built to handle a lot of different inputs and make sense of all the data from across an organization. They do an amazing job as a generalist tool that helps prepare Accounts Payable clerks and other employees to input data into the system, from multi-billion-dollar companies down to small businesses.

However, while ERPs can successfully streamline all sorts of business processes, being a generalist means that their capability for detailed AP processing can have its limits. Often, creating an efficient AP automation process within an ERP – or across multiple ERPs – expends unnecessary time and resources in custom design and implementation. On the other hand, despite a company like Yooz making AP automation easy to customize and use, many companies fear that integrating with an outside platform means that that their data will be lost and workflows will be interrupted both during and after combining systems. Other businesses simply don’t understand the real purpose and mechanics of their ERP.

Industry watchers at Levvel Research found astonishing gaps when polling finance leaders and AP executives about their understanding on the importance of ERPs, their primary role in the finance department’s AP process and how well AP and ERP systems play together. In their most recent 2020 Payables Insight Report Level states “ERP-based AP software is the most widely used tool by finance departments … Because the ERP is often a fundamental component of the finance and accounting process, it may seem natural to use an AP module within the system, but this is a misjudgment of an ERP’s primary purpose.”

The report also states that “ERPs are best suited as financial repositories and are incapable of truly automating the AP function, as they don’t have the robust capabilities of software designed solely for this purpose.”

More specifically, “While not a module of an ERP, cloud tools can be closely tied to an ERP through integration; some have specializations or features for specific industries or market segments. Cloud tools also offer a host of benefits beyond the ones most frequently cited. For example, survey respondents reported that they were enabled by their software to expand their international presence, achieve ROI earlier than projected, and modernize their entire finance function.”

This is not to say an ERP isn’t effective, but reports show that combining the right AP automation solution with your ERP will level up and streamline your AP process. Even if your ERP comes with a lot of amazing features, there is always room to make it even better.

A perfect example? The partnership between Yooz and Microsoft Dynamics GP.

Yooz and Microsoft Dynamics GP Accounts Payable Automation - The Perfect Match

You may be wondering why you should integrate your ERP with AP automation if its capable of so much on its own. A great example is looking at how well Yooz works with Microsoft Dynamics GP, the highly customizable ERP automation system.

Companies using Microsoft Dynamics GP can take modernizing their AP function even further thanks to the partnership with Yooz, integrating the powerful and highly customizable AP automation solution to create a single, seamless, and end-to-end ERP automation system. In fact, you can say that the two are a perfect match for each other, combining a top-notch ERP with the best in AP automation software. And, from the moment a company decides to embrace full-fledged automation, Yooz implementation specialists are part of the onboarding journey. They are dedicated to understanding company specific unique processes and workflows, then using these insights to create a customized integration between Microsoft Dynamics GP and Yooz.

The partnership ensures a seamless and painless integration process, one with a dynamic, automated workflow from purchase to payment, with automatic and ongoing data exchange in addition to data storage in the cloud. Questions? Concerns? Information can be accessed either on the Microsoft Dynamics GP interface or the Yooz platform. No lost information and no interrupted workflows. All parts and factors work together, making a difference to any organization with goals to grow, be more efficient, and become more productive.

Here’s how Jill Filipiak, VP of Finance with restaurant franchiser Falcon Holdings and Yooz/Microsoft Dynamics GP client, describes her experience of integrating the two systems:

"Yooz was a game changer for our business. Our restaurants are located all over the U.S. and Yooz was instrumental in streamlining our approval process. The invoice is easily tracked in the system from when it is uploaded, approved, and processed in Microsoft Dynamics GP. The multiple-level approval module is very flexible to customize by company, person-specific approval level, vendor, and dollar amount. The possibilities are endless.

The personnel in the field and accounting have the ability to upload the invoice keeping us paperless and giving everyone who has access the ability to easily view the invoice with the extensive search engine when questions arise.”

Filipiak adds her final thoughts on her department’s new seamless and customized AP process: "Yooz has organized our AP process from beginning to end."

With all the benefits that come from pairing the smartest technologies with a complete, end-to-end personalized workflow, what are you waiting for? An integrated Yooz plus Microsoft Dynamics GP means that organizations can rest confident that their process are working for them better and faster, 100% of the time.