|

Business-to-Business (B2B) transactions is a dynamic, constantly evolving area, one that plays a key role in the success of any business operation. Let's take a quick look at the modern world of B2B payments: the most common payment methods, key benefits and challenges, and noteworthy future trends in financial exchange.

|

In today's constantly evolving business landscape, cutting-edge technology is steadily reshaping traditional business practices. This transformation is having a significant impact on all aspects of modern operations but especially so when it comes to Business-to-Business (B2B) transactional processes. Part of these - the consumer-facing industries - have readily embraced digital innovations. The other part has been slower to adapt.

However, the adaption rate for B2Bs is accelerating as businesses increasingly recognize the advantages of payment automation. A key driver of this change is the growing reliance on technology by individuals for effortless digital transactions in their daily lives. This normalization has created a demand for the same level of convenience and efficiency in B2B payments; a demand which is likely to continue to push organizations towards adopting payment automation solutions.

What is Payment Automation

Today the term "payment automation" has become more than just a buzzword; it is a transformative force for business operations. Picture being able to effortlessly handling invoices, payroll, and supplier payments without manual intervention. All this case be achieved thanks to payment automation: optimized processes, reduced errors, increased efficiency, and complete transparency.

Furthermore, these advantages aren't limited to businesses with large budgets or just large corporations. Regardless of whether you're a small startup or a global enterprise, adopting payment automation can result in significant benefits to your operation.

Why Switch to Automation?

The benefits of adopting payment automation are compelling:

- Speed and Accuracy: automated systems process payments faster and accurately, minimizing delays and human error.

- Cost Savings: automation reduces expenses such as paper, postage, and administrative overhead such as data entry and paperwork.

- Security: Encrypted channels protect sensitive data, helping protect against fraud.

- Scalability: Payment automation seamlessly scales with your business.

- Visibility: Real-time tracking and reporting provide insights into cash flow and financial health.

Quick Fact

|

|

The B2B payments market, valued at $994.2 billion in 2022, is projected to reach $2.1 trillion by 2030.

|

What are B2B Payments?

B2B payments, short for Business-to-Business payments, refers to financial transactions that occur between companies rather than those involving individual consumers. However, just like Business-to-Consumer (B2C) transactions, payments can be either a one-time or recurring occurance (depending on the agreed upon terms).

Unlike most B2C transactions, B2B payments typically involve larger sums of money, extended payment terms, and detailed negotiations. Furthermore, in the case of multinational corporations, there is also the need to account for and manage influencers including diverse currencies, payment systems, government regulations, and tax structures. The complexity of all these additional factors makes it even more important to choose the right payment methods to maintain smooth, end-to-end financial operations.

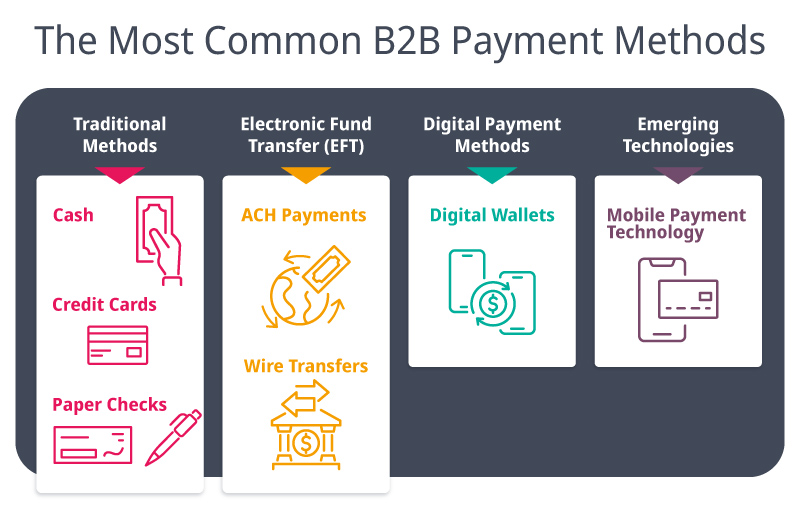

The Most Common B2B Payment Methods

B2B payment methods consist of a broad range of traditional, digital, and emerging digital payment platforms and options. Each one comes with its own strengths and considerations.

Let's review a few of the more commonly known.

1. Traditional Methods

Traditional methods have long been the foundation of B2B transactions, providing both reliability and familiarity.

- Cash

While accepting cash is less common in B2B transactions due to concerns regarding payment fraud security concerns and convenience, this form of payment is still utilized in certain circumstances.

- Credit Cards

Credit cards are both widely accepted and convenient, as well as offering the possibility of reward programs with cash back opportunities, travel point programs, and discount options. For example, a company can earn cash back on office supplies or travel expenses each time that they make a payment.

Credit card statements also provide a clear record or transactions that allow businesses to track payments, monitor spending patterns, and reconcile accounts on a monthly or yearly basis. Note that credit card fees can quickly become a concern for companies if not paid off in a timely manner.

An alternative to the physical card - virtual credit cards - are quickly gaining popularity. In fact, a 2023 study by Juniper Research predicts that the total number of virtual credit card payments will reach $175 billion by 2028; a 388% global increase from $36 billion in 2023.

These digital cards exist only in an electronic format, are generated for specific transactions, and are valid only for a single use or a limited time. This alternative to physical cards further streamlines the payment processe, offering benefits including real-time transaction data, reduced risk of fraud, vendor-specific allocations, and controlled spending.

- Paper Checks

Despite the progress made in digital payment methods, paper checks remain common in B2B transactions with businesses issuing checks to pay suppliers, vendors, and service providers. While using paper checks provides a physical record of payment, their manual processing and potetial for delays present notable drawbacks.

2. Electronic Funds Transfer (EFT)

EFTs are often used for large transactions, providing a secure way to transfer funds electronically between banks.

- ACH Payments

The Automated Clearing House (ACH) network is a system in which funds are electronically transferred between bank accounts and other financial institutions using a routing number and bank account. It is the primary system used for Electronic Funds Transfers (EFT) and known for its efficiency, cost-effectiveness (often free or with a nominal charge), and reliability. In fact, regardless of the amount, payments take an average of 1-2 days. This makes them a popular choice for recurring payments and large transactions.

However, there are certain limitations associated with using ACH payments. For example, ACH payments are restricted to domestic transfers between accounts within the United States. If you need to send money abroad, you will need to use an alternative network or specialized international payment service.

Furthermore, ACH operators process transfers only four times a day in specific batches. Missing the daily cutoff time means that a payment can get postponed until the following day, potentially causing delays for businesses.

Quick Fact

|

|

According to AP's Payment Costs 2022 Benchmarketing survey, the average company sends between 1,000-1,900 ACH credit transfers, making it the most common payment form after checks.

|

- Wire Transfers

Wire transfers, like ACH transactions, are digital payments made by direct wire transfers between bank accounts using a secure network. However, unlike ACH payments, wire transfers extend to international payments.

Because they are not processed in batches, wire transfers are immediate and irreversible, and may have higher fees compared to ACH due to their speed and international capability.

Quick Fact

|

|

Automatic payments through the ACH payment system are increasing in popularity with steady growth every year since 2014. In fact, according to Nacha, the National Automated Clearing House Association, 2023 marked the 11th consecutive year in which the ACH Network value increased by over $1 trillion.

|

3. Digital Payment Methods

With the rise of technology, digital payment methods continue to become increasingly popular for both B2B business payments and B2C business transactions.

- Digital Wallets

Digital wallets have gained significant traction, accounting for nearly half of global online transactions in 2022. By 2026, this share could increase to 54%. Their popularity stems primarily from their ease of use. Users simply download a mobile application and securely store their payment information within the digital wallet. Then can then seamlessly conduct transactions both in-person at physcial stores and online.

Digital payment platforms such as PayPal, Venmo, Apple Pay, and Google Pay offer both convenience and rapid transaction processing. These platforms can be used to electronically transfer funds, typically between two parties. Their popularity continues to grow particularly among the younger and mobile-savvy demographic, highlighting their impact on financial transaction methods.

4. Emerging Technologies

As technology continues to evolve, new mobile payment apps and methods are emerging with promising heightened security and efficiency.

- Mobile Payment Technology

Thanks to the impact of COVID-19, the use of contactless in-person payment methods continues to steadily increase. Like many other options, these innovative technologies offer both speed and security, allowing for seamless transactions at any time and place.

Two of the main types of this technology are:

- Tap-to-Pay: This includes digital wallets used in person and contactless credit cards with chips that can be tapped over payment terminals.

- QR Codes: Found nearly everywhere, QR codes are here to stay. In fact, one survey by Statista found that an overwhelming 59% of respondents believe that QR codes would become a permanent part of their mobile phone usage.

In summation, there are a variety of B2B payment methods that offer businesses a range of choices to cater to their specific requirements. By understanding the characteristics of each payment method, businesses can choose the best payment process that suits their needs.

What is the Best B2B Payment Method

Is there such a thing as a single "Best B2B Payment Method"? The answer is no, not exactly.

The best B2B payment solution will depend on the specific needs and priorities of the business. Each payment type has its benefits and limitations.

6 Advantages of an Efficient B2B Payment System

There are several reasons why an efficient B2B payment system is important. Here are 6 of the main advantages:

1. Cash Flow Management

Efficient B2B payments ensure a smooth cash flow, preventing delayed payments or inefficient payment processes that can lead to financial strain and operational setbacks.

2. Cost Savings

Streamlining B2B payments reduces transaction costs, manual processes, and errors. This can lead to significant savings and improved overall efficiency.

3. Enhanced Relationships

Smooth, timely, and secure payments promote trust and reliability between business partners, potentially improving contract terms and leading to additional collaborations.

4. Compliance and Risk Mitigation

An efficient, transparent B2B payment system helps adhere to regulatory compliance and mitigate errors and fraud risks, offering better oversight and control.

5. Global Operations

A streamlined B2B payment system helps navigate diverse currencies and regulations. This facilitates cross-border transactions while minimizing potential exchange risks and helping to ensure compliance with varying regulatory frameworks.

6. Competitive Advantage

Efficient workflows enable agile responses to market changes and customer demands, providing a crucial competitive advantage in today's fast-paced business environment.

Challenges in B2B Payments

Despite advancements in technology, B2B payments continue to face significant challenges that impact operational efficiency, cash flow, and security. These include:

Manual Process and Inefficiencies

Many businesses still rely on traditional and slow processing methods such as using paper invoices and checks, especially for high value transactions. These processes introduce inefficiencies that can lead to payment processing delays and hinder operational efficiency.

Delayed Payments

In particular, manual processes often result in frequent payment delays within many B2B payment transactions. These delays not only disrupt business operations but can also strain relationships between parties, affecting trust and collaboration.

Increased Security Concerns and Fraud Risks

As financial transactions increasingly move to digital platforms, businesses are facing heightened security concerns and fraud risks. Safeguarding sensitive payment information is vital to reduce any change of fraud or unauthorized access.

Businesses must also adhere to global regulatory frameworks to ensure compliance.

5 Trends Shaping B2B Payments

Even pre-COVID-19 businesses were gradually shifting to digital behaviors, using mobile apps and transfers for purchasing goods and services. The lockdown further hastened this shift, rendering cash less relevant in nearly every aspect of daily life.

Simultaneously, there is a decrease in cash usage, with studies showing a four percentage point decrease globally in 2022. Meanwhile, the growth rate for electronic transactions surged, achieving nearly triple the overall growth in payments revenue during a five year period.

These changes signal an approaching transformation in B2B payments.

1. Decline in Paper Checks

More traditional payment methods such as B2B paper checks have been in steady decline, falling by over 40 percentage points to an all-time low of 33% since the Association of Financial Professionals (AFP) began tracking data in 2004. Why the shift away from paper checks to electronic alternatives?

One reason is speed and efficiency. Electronic payments offer faster processing times compared to even just mailing and inputting physical checks.

Second, traditional paper checks are susceptible to loss, theft, and fraud. Electronic B2B payments are more secure, with factors like encryption and authentication protecting sensitive financial information.

Third, digital payments offer greater cost savings. Printing, postage, manual handling, and other costs associated with paper checks quickly add up. Electronic payments eliminate these expenses and contribute to greater cost savings for both payers and recipients.

However, despite usage being in decline, checks are expected to remain relevant for years to come. In fact, according to a study by PYMNTS, although the number of checks has been steadily decreasing, the average value of check transactions have increased. This makes efficient handling of them crucial for successful capture and posting of payments.

2. Real-Time Payments

Real-time payments offer the benefit of instant or near-instantaneous fund transfers, simultaneously eliminating traditional delays associated with bank processing times and optimizing cash flow management. This streamlined payment method enables companies to swiftly access funds, improving agile resource allocation.

However, while accelerated transactions offer advantages including speed, convenience, and always-on processing, they also introduce risks such as fraud, operational errors, and compliance challenges.

Regardless, as real-time payments become more prevalent with an expected growth rate of 289% from 2023 and 2030, businesses must proactively implement measures aimed at mitigating risks and ensuring security and sustainability.

Quick Fact

|

|

Gartner's Future of Sales Study found that 80% of sales interactions between B2B suppliers and buyers will occur in digital channels by 2025.

|

3. The Rise of Cryptocurrency and Blockchain

Another significant trend in B2B payments is the growing acceptance of cryptocurrencies such as Bitcoin. Their importance and influence will only continue to rise as businesses increasingly recognizing the potential of crypto currencies in expediting cross-border transactions, reducing transaction fees, and enhancing security.

Just consider the staggering growth: In April 2013 there were only seven cryptocurrencies. By the end of 2014 this number had skyrocketed nearly tenfold to over 500. Fast forward to 2024 and there are over 10,000 cryptocurrencies in circulation with a market capitalization of over $1 trillion.

Just consider the staggering growth: In April 2013 there were only seven cryptocurrencies. By the end of 2014 this number had skyrocketed nearly tenfold to over 500. Fast forward to 2024 and there are over 10,000 cryptocurrencies in circulation with a market capitalization of over $1 trillion.

The foundation for cryptocurrencies is known as blockchain technology, a decentralized ledger system known for its ability to ensures transparency and security in transactions. Specifically, blockchain technology reduces the risks associated with fraud and errors by providing unchangeable, transparent transaction records. This in turn fosters trust and confidence between transacting parties.

4. Increased AR and AP Automation

By 2025, a projected 80% of B2B sales interactions expected to occur in are expected to take place through digital platforms. This shift towards digitalization is prompting a greater adoption of automation in all areas of business options, including in the Accounts Receivable (AR) and Accounts Payable (AP) financial processes.

In addition to automating AR and AP processes to streamline the payment process, modern technology such as Artificial Intelligence (AI) and Machine Learning (ML) are replacing manual processes by automating repetitive tasks, reducing human error and improving efficiency. These solutions have a positive effect on the entire invoice workflow; streamlining invoice processing, reconciling payments, and even managing cash flow, leading to significant cost savings and enhanced business productivity.

As digitalization continues to advance so too will the evolution of AR and AP processes, leading to improved financial operations. Business that proactively embrace automation will be better positioned to thrive in the ever-evolving B2B digital payments' space.

5. Embedded Payments

Embedded payments seamlessly integrate their payment processing capabilities directly within software applications or platforms used by businesses. By eliminating the need for separate payment processing systems, embedded payments offer a frictionless experience within existing, familiar workflow environments. Some of the reasons that adding embedded payment processing functionalities matter include:

- Increased customer satisfaction: Workflows that seamlessly incorporate payment capabilities offers a smoother and more efficient process, enhancing customer satisfaction.

- Accelerated revenue collection: Revenue can be collected faster, reducing delays and administrative overhead. This results in improved cash flow management.

- Streamlined financial operations: Consolidating payment functionalities simplifies financial management, enabling a seamless tracking and reconciliation process. This leads to greater operational efficiency.

In summation, embedded payments seamlessly integrate with familiar software environments, contributing to financial success.

Best Practices for Optimizing B2B Payments

As you have learned above, optimizing B2B payment processes plays a crucial role in driving efficiency and cost reduction. To help you, here are some best practices:

1. Embrace Electronic Invoicing and Billing Systems

Transitioning from traditional paper-based invoicing to electronic payment systems can significantly streamline the entire invoice and payment process, minimize errors, and reduce delays associated with manual data entry. It also provides a transparent transaction trail for review and auditing purposes.

2. Implement Automated Payment Workflows

Automating payment workflows can help businesses eliminate repetitive manual tasks, save time, reduce errors, enhance cash flow management, and ensure timely payments.

3. Leverage Data Analytics

Data analytics offers insights into payment patterns, vendor performance, and potential cost-saving opportunities. By analyzing historical data, businesses can identify opportunities for improving contract terms, optimizing payment schedules for discounts and cash back opportunities, and lower the risk of making late payments. In addition, analytics can help to detect anomalies or fraudulent activities to improve payment security.

4. Establish Strong Vendor Relationships

Building strong vendor relationships is essential to fully optimizing B2B payments. By establishing clear lines of communication and pursuing mutually beneficial initiatives, business can achieve bettr payment terms, lower expenses, and improved operational efficiency.

By incorporating these best practices, businesses can use B2B payment transactions to drive greater efficiency and profitability.

Conclusion

In conclusion, the world of B2B payments is in a constant state of change, driven by technological advancements and shifting consumer behaviors. As businesses increasingly embrace digitalization, payment automation stands out as a key element in financial operations, offering speed, accuracy, and security.

Reach out to Yooz today and find out how comprehensive Purchase-to-Pay (P2P) automation can benefit you!