After years of false starts, Accounts Payable automation has started to become more common in Accounts Payable departments.

An eye-popping 84 percent of Accounts Payable practitioners are optimistic about the progress their department will make over the next three years in eliminating paper invoice and payment processes. That’s according to the Institute of Finance and Management’s (IOFM’s) 2018 Future of Accounts Payable Survey.

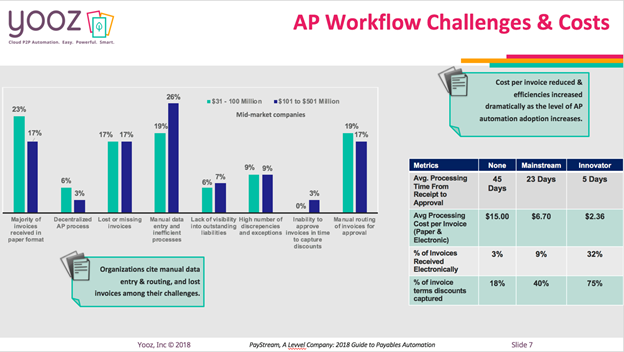

Companies are starting to see a need for automation in the Accounts Payable and invoice approval process and the reasons are clear. We’ve all heard them: Saving time, saving money, increasing efficiencies and staff productivity. Specifically, Levvel Report’s 2018 Guide to Payables Automation stated that mid-market organizations cite “manual data entry and routing, and lost invoices among their main challenges”. But for finance leaders, what does that mean exactly?

Benefits of Accounts Payable Automation to the Bottom Line

In this blog, we’ll calculate how the benefits of Accounts Payable automation translate directly to the bottom line, giving real examples from industry research and real Yooz customers.

Increased Productivity Throughout the Accounts Payable Department

Industry reports cite better staff productivity as the top reason for automating. Highly automated accounts payable departments process 16 times as many invoices per FTE each month as their peers with little or no automation, per IOFM’s “Is Your AP Performance Top Tier?” white paper. [1] 1,350 invoices/FTE processing manually versus 22,756 invoices/FTE with a highly automated workflow, to be exact. Simply put, you can do more with your existing staff. Not only that, but by reducing the manual and mundane tasks staff will be freed to do more strategic value-added work, such as improving supplier relationships and leveraging early payment discounts (more on that later).

Tim Carter, CFO, Salsarita’s Fresh Mexican Grill knows. “Rather than hiring additional people, give your existing staff the automation tools to make their roles multi-faceted. Your finance department—all departments for that matter—can run lean and take on more strategic, value-added duties. Had we not implemented the Yooz solution, we would have had to hire additional bookkeeping staff by now”.

The Dollars and Sense?

Multiply the salary/wages of one Accounts Payable department full-time employee times the number of staff you would need to hire as your invoice processing volume grows. That’s how much you’ll save with an automated Accounts Payable and invoice processing solution.

Capture 97% of Early-Payment Discounts Offered

Eighty percent of the businesses surveyed for IOFM’s Accounts Payable Department Benchmarking & Analysis report receive invoices from vendors that offer discounts on the invoice due amount in exchange for early payment.

With an automated system and the ability for approvers to access documents in the Cloud from anywhere at any time, invoices move efficiently through the process. No more lost invoices. No more invoices getting stuck or going missing in the approval process. No more late payments.

Bryan Schmidt of UNITE HERE HEALTH notes, “Now what’s interesting is as far as the savings we’ve achieved with Yooz is that it has been a greater productivity. I’ve been able to redeploy my AP staff. Also, to it has given us more mobility meaning we can approve invoices from anywhere”.

The Dollars and Sense?

Multiply the average dollar volume of invoices paid per month by 10% (the average early payment discount offered by suppliers). That's how much you have the potential to save with an automated invoice and payment processing software.

Save Money on Shipping and Storing of Invoices and Documents

When finance leaders think about the cost of processing invoices, they might only consider number of staff and time it takes each to manually enter data, track down lost invoices, and get approvals. But what about the costs to ship invoices to a central location for processing via courier or overnight service? Or storing boxes and boxes of paper invoices and documents? Those are real tangible costs that are eliminated with Accounts Payable automation software. Ask Tim Carter, CFO, Salsarita’s Fresh Mexican Grill, Jason Kleve, Controller Transwest Auto Group, and Bryan Schmidt, UNITE HERE HEALTH:

- Salsarita’s store managers at each of the individual restaurants were manually receiving paper invoices—food and supply delivery people would leave paper invoices along with the delivery—then routing these documents back to headquarters either via courier or overnight services, costing hundreds of dollars a week.

- Transwest was spending thousands of dollars a year storing, shredding, and shipping invoices from dealership to central processing. According to Jason Kleve, “Storing documents in the cloud has solved most of our pain points. Documents are easily accessible by all department managers. It’s much more secure. And we’re saving money and time by not shredding, storing, or shipping documents”.

At UNITE HERE HEALTH all regional offices were required to collect documents and send them to headquarters or the Las Vegas office for manual entry, proper coding, review, and approval for payment. And each year, boxes full of paper invoices had to be packed, shipped, and stored offsite. Bryan Schmidt added, “With Yooz, we know where documents are at all times. Before, it may have taken hours to find out just what the columns were. People would come to my office to look for files or invoices. Now, I can find things quickly and run reports since I have easy access to all relevant documents”.

The Dollars and Sense?

Easy! Tally up the total cost spent each year on the shipping and storing line item on your expense sheet. When that number becomes $0 with the Yooz Accounts Payable automation solution, the savings go straight to the bottom line for your organization.

Spend Only $2.36 to Process a Single Invoice

Automation eliminates the manual processes that drive up the cost of accounts payable processing—to the tune of more than $15 per invoice on average—including additional staff as volume of invoices to process increases, keying invoice data, physically routing invoices for approval, filing invoices, and all the things we’ve covered so far in this blog series.

Additionally, Patsy Price, Director of Operations for Peterson Auto Group said, “We’ve all heard the saying ‘Time is money.’ Entering an invoice used to take about five minutes. Now it’s 15 seconds or less”.

Levvel Research puts the numbers to it:

- Cost per invoice reduced and efficiencies increased dramatically as the level of Accounts Payable automation adoption increases

- The average processing time from receipt to approval for a company without automation is 45 days while companies considered “innovators” to Accounts Payable automation only take on average 5 days to process an invoice

- Percent of invoice terms discounts captured by those companies not automating their invoice process is only 18% while the “innovators” with high Accounts Payable automation are seeing on average 75% of their invoice terms capturing a discount

The Dollars and Sense?

Peterson Auto Group saved more than $35,000/year when she switched from a manual invoice processing and payment workflow to Yooz Accounts Payable automation? Real savings translated into real profits.

“Since implementing Yooz for our five-store dealership group, the invoice processing time has been reduced by 50%, the cost associated with cutting checks has decreased by 75%, saving us nearly $35,000 a year, and our GMs have complete visibility into our AP process”.

Now those are dollars you can make sense of!

In the meantime, check out the Yooz savings calculator and start saving money today.

FAQs

How can Yooz demonstrate the return on investment (ROI) of implementing AP automation within our organization?

What are the typical cost savings that organizations can expect to achieve by implementing Yooz's AP automation solution?

How quickly can we expect to see a return on investment after implementing Yooz's AP automation solution?

Beyond cost savings, what other benefits can we expect from implementing Yooz's AP automation solution?